This is a special report on the Flash Crash of January 3rd, 2019. We explore how to trade Forex after occurrences like this on Monday’s podcast.

But for now, we need to understand how and why these things happen.

Again, the “how to trade afterwards” part will be covered on the 1/7/19 podcast, not here.

This is just a rant, and a bit of education from your favorite contrarian.

It would really help if you’ve already seen my Big Banks video. It’s the most popular video I have, and the video most of my traders see first. Good thing too…

Make No Mistake

A Flash Crash is a planned attack on the market, for immediate financial gain.

It is never anything else.

The excuses the media gives are laughable and easily debunked. But you believe them, because you don’t know any different, and they’re the financial media, and they talk all smart and stuff.

More on this in a bit.

But Wikipedia defines a Flash Crash as “a very rapid, deep, and volatile fall in security prices within an extremely short time period”

I’m going to refer back to this definition as well. Remember it.

So What Just Happened?

On January 3rd, 2019, the AUD got really weak, and the JPY got really strong in a very short amount of time.

The AUD/JPY fell 7%(!!) in a matter of minutes.

The fundamental correlation most people follow is that AUD is the pro-China play, and the JPY is the anti-China play.

Seven percent, even in a week, is insanely rare for a major pair to rise or fall. But an hour??

What would cause such a move?

Did China decide to move back to full-blown communism?

Was there a junta, and the president got shot?

Did an atomic bomb hit Beijing?

No.

Apple blamed Q4 losses on a slowing Chinese economy, which everyone already knew about.

………that’s it?

I scoured the interwebs for reasons, and it all kept coming back to this.

An article here from the Financial Times breaks it down.

ForexLive had a nice piece on it here. Go to 3:03 in the video.

Both sources stated low liquidity levels for playing a part.

Let’s break all of this nonsense down.

Low Liquidity Levels

Okay, understand this please.

Periods of low liquidity happen every single day in the Forex market.

During these times, freak news events have come out of nowhere.

You can debate whether the low liquidity at the time really does add to the severity of the fall, or if having more volume (more people trading) would be more necessary for a sharper decline, but we’ll set this aside.

But these events would typically affect a currency pair as much as 1%, mayyyybe as high as 2%, but rarely ever more than that.

A 1% move in a pair in a short amount of time, is quite newsworthy. If you’ve ever had a 1% move either way in a pair you were trading, you sure as shit felt it.

But 7%? Seven freaking percent??

Low liquidity had very little to do with this.

But you’d likely believe it if somebody told you.

They play off of your lack of education here, and your automatic relent towards people who are in the industry.

And this is just one of the excuses they gave.

Apple Made A Report!

OMG OMG OMG!!

Did you guys hear that?

Apple made a report that was kind of sort of unflattering about the Chinese economy!

So Apple comes out and states their 4Q numbers are going to be down a bit due to an apparent slowdown in the Chinese economy.

Okay, so what?

Least surprising thing ever.

It’s not some top secret that China’s economy is slowing down. Almost everyone in the game already knows that.

Here’s a chart of the SSE (Shanghai Composite) for the past 6 months. The Hang Seng chart (Hong Kong) is no different.

So Let Me Get This Straight

During periods of low liquidity (which doesn’t mean much), a fairly vanilla stock report came out (based on info we already knew)…..

And the AUD/JPY fell seven percent???

You cannot be dumb enough to fall for this.

Before we get to the biggest reason you’re being played right now, let’s just point one additional thing out here.

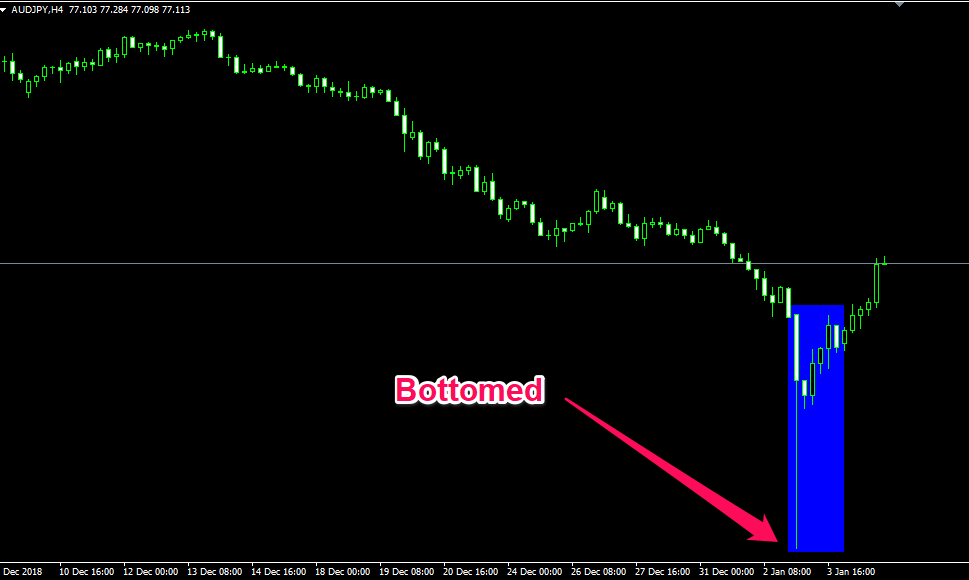

Here is a 4H chart of the AUD/JPY during the Flash Crash 2019

Pretty severe.

A move like this should send shock waves throughout the entire global market, no?

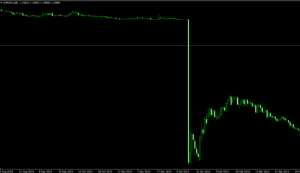

Here’s the S&P during that same time:

Business as usual.

Hang Seng and Shanghai Composites were not greatly affected either, for the sake of space, you can research this yourself if you like. More dramatic than the S&P, but not by much.

This was a pure currency manipulation move.

And all of the excuses given for this move downward never answered the one big remaining question…

The Smoking Gun

And the big remaining question is….

Why did the AUD/JPY go right back up?

Nice little bullshit-ass excuses for the fall there, financial media.

But if they were such legitimate reasons, why did price spring right back up??

Where’s Wallace, String? WHERE’S WALLACE??!!

Where are your reasons now, financial media?

Your reasons for the drop got completely destroyed in a matter of hours.

Stringer Bell couldn’t answer D’Angelo, and the media has no answer for why price immediately rebounded.

It would be best if you just came out and admitted it.

But you won’t.

It’s not in your best interest to do so.

So I’ll do my best to explain.

Why Do This?

Nothing to see here people, just a bunch of Banks and/or major institutions knocking out a slew of orders at one time and/or getting a sweet deal on the AUD, move along now.

We spoke last week about sentiment, and in the blog for it, I made a reference to how the AUD/JPY had 89% of its traders going long, trying to catch a bounce.

89% is an insane number. It’s almost a 9:1 ratio, which you almost never see on the SSI Indicator in Forex.

And the number of traders doing this just kept on rising.

This presented a rare and great opportunity for the Banks to cash in.

“Let’s take some minor news, make it sound catastrophic, and Flash Crash this sucker. Oh, and make sure it happens during low liquidity time so we have another built-in excuse. The combination of the two cannot be refuted!!”

(Not a direct quote)

Now do you think Japan is going to be super cool with their currency getting 7 percent more expensive against one of their biggest trading partners overnight?

Certainly not. This would be an understatement.

Long-term, the Japanese government may want the JPY to go up or go down for whatever reason, but it will happen gradually, and on their own terms. Certainly not like this.

So to avoid an impending foreign shitstorm, the Banks took what they needed, and put everything right back as they found it.

Just like a great thief would.

The AUD/JPY only closed about 83 pips down on the day, and they immediately rebounded back upward to the levels at the close of 2018.

But not before a bunch of people’s accounts were blown out due to slippage. And not before a bunch of stop losses got taken out, and a bunch of long limit orders were triggered, and those long traders panicked and exited.

The major players all win, the spot traders lose.

No different than any other day, just more severe this time around.

Anatomy Of A Scam, Part XXVI

There are three main reasons IMO why the Banks and major institutions get away with this.

- The media is right there to explain it away

- They’re too big to punish. Any fines they get for fuckery result in parking ticket-level money.

Reason number three, like the Dual-Line Scam in my “Patience” video, is one that fascinates me.

3) You can get away with major greedy shit, as long as you space it out enough.

In the restaurant world, where I come from, there are dozens of ways to manipulate the system, through the computer, or promotions, or whatnot, for the purpose of stealing money from your place of employment.

I never did this. Not for moral reasons though, I would have loved to have stolen from some of these awful places, but because the risk/reward wasn’t there.

This is Vegas mind you, very top-end waiter jobs are plentiful here.

I could not justify endangering an $80,000+ per year job for a few extra twenties here and there. Not even a few extra hundreds.

And then you have that shit on file forever that you stole from your work.

Not for me. But I saw, at every single place I worked, people who would take money that wasn’t theirs constantly.

One group of people always got caught. The other group, very seldom got caught.

And this was consistent across the board.

The dumbasses who would steal on the regular would always get caught, because as slick as they thought they were, abnormalities would pop up in accounting, and now they were on watch. And the computers would show proof over time of theft.

The people who had the patience to steal every once in awhile, spacing it out every month or two, never tripped the sensors, and never got caught.

And it was the same for people who were stealing wine, steaks, silverware, whatever.

Just like everywhere else, instant-gratification monkeys getting slaughtered, and patient, surgical tactitians walking home with the loot.

The same goes for flash crashes. You can’t just up and do that shit all the time. You got to space it out, over years, across multiple markets.

The Wikipidia page on Flash Crashes again does a good job of showing you how this has been done recently.

2019 – AUD and JPY

2017 – Ethereum (more on this in a minute)

2016 – GBP

2013 – Singapore Exchange

And I can recall a few times of this happening in the US Stock market.

I was watching CNBC (it was 2010, I was dumb) when one of them occurred, and as it was hitting the bottom, somebody alerted Jim Cramer to it, and he immediately knew what to do.

The video can be found here, at 5:00 is where it gets good. It’s funny because nobody else knew what was really going on.

He did blame it on machines (LOL), but he knew what was occurring.

Remember, if you’re just wise enough to space it all out, nobody will raise any questions, and you can have your once every three years mega-bonus for fleecing everyone else.

Ethereum And The Power of Self-Interest

Real quick, I wanted to mention one of, if not the most flagrant examples of a flash crash.

On June 22, 2017, ETH went from slightly over $300 in value, all the way to close to 9 cents!!

And then right back up again. As you do.

It was blamed on a big sell order, that tripped a bunch of algorithms (blaming it on machines again), as to why it fell.

But again, no real explanation as to why it went right back up.

Well at least they fixed the problem, and it won’t happen again, right?

No, it happened last month again!

This time from just under $100, to $13, then right back again.

As you do.

Tell me which of these you think is more plausible:

- Machines just keep messing up man, I don’t know what to tell you

- A group of powerful people knew, that if they got together and orchestrated it, they could cash out gigantically, and then soon after buy a bunch of ETH for dirt cheap, since they knew exactly when and where it was all going down.

Be honest, if you could, without any legal consequence, would you partake in something that could make you millions in an hour’s time?

Even if you said “no”, you know damn well there are plenty of people out there who would.

Never rule out self-interest, because it’s the #1 driver of just about every decision ever made.

And ATTENTION ETHEREUM THIEVES:

You’re being sloppy. I know, you’re brand new at this, but…

You can’t do that shit on one currency once a year. That’s way too often. You’re gonna raise suspicion.

Fat Finger Freddie

The last ETH crash was mainly blamed on somebody selling way more than they intended to, a phenomenon know as “fat fingering“, because your fat finger hit the wrong button, adding extra decimal places to your order.

The one flaw with blaming this move, is that (hence the word “Crash”), it only happens when people short something.

I know, I know, there might not be enough of whatever you’re buying out there to fat finger something to the long side, but there often is. Yet, we only see it when it’s a monster sell.

No proof of anything here, no hard opinion, just food for thought.

Flash Crash Redefined

You may be wondering why the EUR/CHF crash of 2015, or the giant candle formed after the 2016 Brexit vote weren’t mentioned here.

It’s because I do not define those things as a Flash Crash.

It’s exactly what they are by definition, don’t get me wrong, but…

- Those giant candles were caused by actual events, not market fuckery

- A Flash Crash to me is when it immediately goes right back up to near or where it began

And Flash Crashes are way more interesting to me for those reasons. They are very unique unto themselves, and I’m amazed nobody else has a different take on them like I do.

Agree or disagree on why this actually happens, I don’t care. I’ve stated my case. Tis all I can do.

But “Giant Candles” by my definition are candles that move dramatically in one direction, and then close there.

How we trade both after they occur are very different, and Episode 29 of the Forex Q&A Podcast will address them both.

Conclusion

I’m a Capitalist, through and through.

But I shake my head when it gets abused like this.

Is full control over the currencies market not enough for you Banks?

You still feel the need to do this?

But it doesn’t upset me, because we here at No Nonsense Forex have found a way to turn this into our advantage over time.

Just ask the hundreds of traders who have turned their results around in the very short amount of time we’ve been around.

But you’ll never be able to do this, if you’re not even aware of who moves the market, how, and why.

Deny this information at your own trading peril. We’ll be over here, making money off of it.

— VP

Before anyone flips out for no good reason, read my disclaimer. I am one man, giving an opinion, nothing more.