Trend indicators are easy to find. A good one is not. There are ways to narrow down the search however to find those diamonds in the rough.

As usual, you can just view the video for this topic here, or continue reading on.

For First-Time Viewers

You need to know what I’m talking about. This is good however, I’ll catch you up right away. Just know at No Nonsense Forex, we…

Ignore the indicators that give us reversals

And generally kick ass.

For Our Regular Viewers

I have given you 3 pieces of the algorithm I use. They are as follows….

- ATR

- Confirmation Indicator

- Exit Indicator

Finding a really good confirmation indicator and exit indicator will take time. It took me years. It should take you a lot sooner than that however.

I was flying blind. I had no idea what to look for. In this blog post, you will have a much better idea of the types of trend indicators to be on the watch for.

Today, I am showing you how to narrow down the search for a great confirmation indicator.

Where To Find Them

I mentioned this a few times, but will do so again. The largest place online I know of is here. There are a good 5-6 places I get mine from. Some are no longer operational, but the indicators are still there to download.

A quick tip is to ignore the star rating at the place I linked. Most people have no idea what they’re doing, and they would not know a great trend indicator if it hit them in the face. Their ratings mean nothing.

The Three Main Types

Moving on.

There are three types of Forex trend indicators you need to be on the lookout for. Neither one is better or worse than the other, you can find great examples and terrible examples for each.

But these are the three you need to look out for.

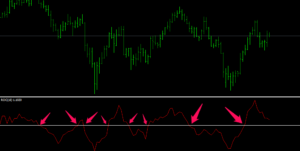

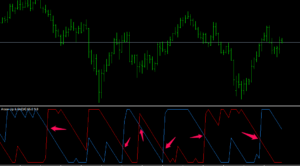

1 – Zero-Cross Indicators

These tell you there’s a trend coming when the indicator line crosses a horizontal zero line. The MACD can do this, the Rate Of Change indicator does this, even though neither one does it very well. But these are examples.

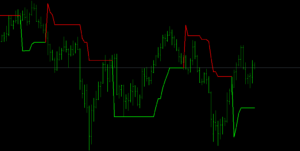

2 – Two Lines Cross Indicator

This is a trend indicator that gives you a signal to go long or short when two of its lines cross each other. The DI portion of the ADX does this. The Aroon Up and Down indicator shown below does this as well.

Signals given when the lines cross. If the red line is higher, go short. If the blue line is higher, go long.

3 – Chart Indicators

It’s a goofy, redundant name, I know. But what I mean by this, is when an indicator goes directly on the chart instead of below.

These will often give trend signals when a particular threshold has been reached. Examples include Parabolic SAR and the SuperTrend indicator seen below.

Criterion Avoidance

When selecting the best indicator for your own algorithm, there are an additional three things you want to be on the lookout for.

1 – An indicator that avoids getting you into a trade too early and often.

A lot of trend indicators do this. Too many bad signals that get your trade stopped out.

Sure, it finds that nice big trend that gave you lots of pips, but it doesn’t make up for all the losses.

2 – An indicator that isn’t too slow

You’ll find this too. You’ll rust before some indicators give you a signal, and when it finally does, most of the trend is already over with.

3 – An indicator that avoids giving you a losing signal, but still gives you wins.

Sounds obvious, right? First, find a few indicators like I mentioned in the two examples above. Then find one that’s just right. One that gives you winner the second one did not give you, but avoids the losers the first one gave you.

Find indicators like this, and save them. There is still a bit of work to be done.

Now The Fun Begins

You have found a handful of trend indicators you like. We now have to whittle them down to find the absolute best.

You will need to test them on different settings.

If you’re testing the Rate of Change indicator I showed you above, take it off of its default setting of 10, and try plugging in other numbers. Do this on every indicator you test.

This is a lot of trial and error, but 100% worth it in the end. Do you want the best, or not?

Also test them all out of different currency pairs. You will notice how some of them under-perform when put on a different pair. This is a bad sign.

Every currency pair will be behaving differently months from now, you want something that can give you winners regardless of the price action.

When You Find Your Sweetheart

Over time, you’ll end up with one or two confirmation indicators you’ll really want to start using.

So go use them. On demo. One of them will certainly rise to the top over time.

…..but keep the other one around. Trust me.

And for the love of God, don’t settle for the one you have. Keep testing, keep searching, keep nerding out.

If you’re not improving in this game, you’re not winning.

One Last Bit Of Good News

Rest assured, even your golden indicator you have chosen above all the others is going to give you a decent amount of losses, especially in times of low volume.

This is where the rest of your algorithm will come into play — eliminating those losses one-by one until there is an abnormal amount of winning going on.

Couple this with spot-on money management, and you have virtually everything you’ll ever need.

— VP