People get really excited when they see the Currency Strength Meter for the first time.

I’ll go ahead and be the one to tell you. It’s time we had “the talk”.

If you’re new to this blog, we tell you what you NEED to hear, not always what you want to hear.

Other sites tell you everything is great all the time, then you go out and lose a bunch of money. Not cool.

And yes, I know there’s a Bitcoin in the picture, we actually talked about it a bit in the podcast.

Don’t get used to it.

But do check out the pod here, or simply continue reading on.

Episode 34’s question is from Solomon:

Having looked at your algorithm, am guessing it includes a currency strength meter of some sort. I got one myself and i must say it compliments the other tools you told us very well. Do you actually use one and how do you do it or is my guess wrong?

Solomon from Kampala, Uganda

We will also tackle the Currency Strength Indicator, which can be a bit different.

What It Do, What It Do?

So what does the Currency Strength Meter do you ask?

It ranks the 8 major currencies (and sometimes others too) based on how strong they’ve performed over x periods of time.

It attempts to give you an overall picture of which currencies have been strong and which ones have been week for those periods.

There are no free pictures for me to use legally for the blog, so just click the link I gave you 4 lines up if you want to see what it offers.

The most common time period is 24 hours.

This can also come in the form of Forex Heat Maps, which essentially do the same thing.

“Honey, You Gotta Come See This!”

When new traders first discover these tools, their jaws drop, and thoughts of money raining down from the heavens saturates their heads.

I mean, a tool, that tells you what just happened?

This is revolutionary!!

Despite this, traders are thirsting for the damn thing.

Don’t believe me? “Currency Strength Meter” gets 14,800 searches a month on Google, on average.*

That’s the exact same search volume as the RSI Indicator!! Bananas.

YOU guys are fired up about it too. I get this question on Ask VP all the time.

And my answer is always the same.

My Charts Already Tell Me This Information

You have charts, right?

You have charts for 27-28 different currency pairs, right?

Well then you, my friend, have a Currency Strength Meter!!

Got me. But I do, of course, have a few theories.

Dealing Desk Brokers, brokers that make money taking the other side of your trade, LOVE to have these on hand for you to see and use.

No believe me?

Oanda has one near the very top of Google when you search for one.

Coincidence? No.

But let me show you what I mean by all of this.

Oh, Well When You Put It THAT Way

I needed to find a website which had a live heat map on it.

Again, “currency strength meter”, “Forex heat map”, same thing.

It’s Saturday as I write this, which is good, it won’t move on us, and we can get a clearer picture here.

Trading View came through! I’ve already linked it above, you you can view it here as well.

We’ll use their map as of 2/16/18 for our data.

They appear to use a 24 hour measurement. This is fine. We’ll use 15 min Forex charts to compare then.

So for example, I’m going through my charts as I often do, and I’m checking out the EUR/GBP, one of my favorite pairs.

(The red line is the start of the new day. Look to the right of it.)

Okay, interesting. Let’s look at EUR/AUD.

Very similar. EUR seems to be driving the bus here, but not in a good way.

One more, just for posterity. How about EUR/CAD?

Now I’m no fancy heat map, but I’m gonna wager to say the EUR is going to come up weak. Because charts.

That Aussie Dollar looked pretty strong earlier, let’s see what it’s doing. We already saw it against the EUR, let look at a good ol’ AUD/USD chart.

Damn, Gina!

We might just be onto something here.

One more, for posterity of course, and because it’s pissing a few of you off.

AUD/CHF

Let’s see if I’m right.

Ima say AUD is gonna be mostly GREEN for strong, and EUR is gonna be mostly RED for weak.

I’ll take a snapshot of Trading View’s heat map to show you all.

Survey says……..

We have a winner.

And that winner, dear trader, is common sense.

Heat maps and currency strength meters are worthless.

Why people get excited over this, I’ll never know.

Why are there scores of YouTube videos saying how vital these useless tools are, I’ll never know.

Actually I lied, I do know the answer. Because it’s so easy.

A: the 99%

Were You Looking For the “Currency Strength Indicator”??

There is another facet of this idea however. This one has legs.

Very weak legs, but still standing.

It’s the Currency Strength Indicator, which is different than a currency strength meter, which we just got done looking at.

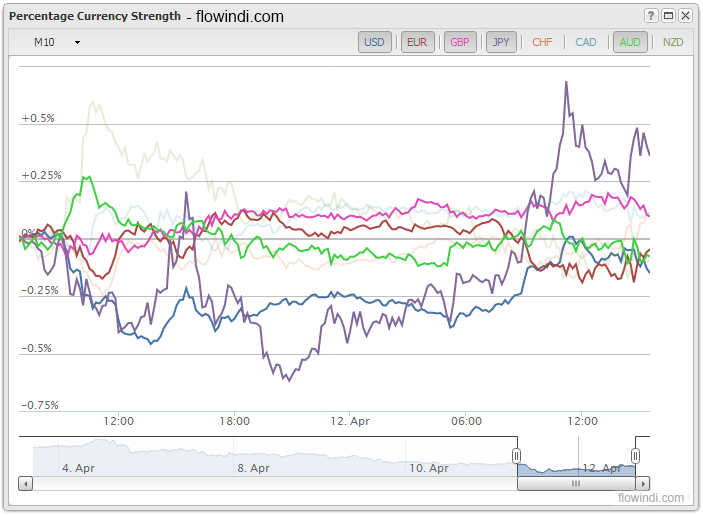

The Currency Strength Indicator looks like this.

Strength of a particular currency is measured by a line.

This is not exciting. This is nothing more than a line version of what we just got done looking at.

But what this does is allow you to overlay other currency’s lines on top of each other, in an attempt to predict where the price of a particular pair may be headed next.

It’s a really exciting idea. This can be used as a two-lines cross indicator, to where you’d make a move after two particular lines finish crossing each other.

Or, as a reversal trade when two different lines both appear to be at extremes.

Won’t lie, this got me pumped up huge the first time I saw it. I spent an entire week, just testing this one indicator out, which is rare for me.

Unfortunately, it just didn’t give me strong enough results to carry forward with it. And believe me, I tried it every which way.

But again, I say this all the time — you and I are different. The systems we built, although based on the same ideas, are also different.

This is certainly worth trying, because the upside for an indicator like this is tremendous.

So test it out for sure.

Just don’t forget one major thing when you do…

Volume Has What Plants Crave

Seriously, if you don’t get the heading’s reference by now, stop talking to me. It’s just not gonna work between us.

You will certainly get better results with this momentum indicator, or really any momentum indicator if you know you have enough volume behind it.

Don’t expect it to work well if you don’t add this part.

As far as students of the No Nonsense Forex way go, you almost want to test this in reverse as you would most confirmation indicators.

Instead of testing it on it’s own, and THEN adding the volume indicator, test it WITH your favorite volume indicator, and only measure ts results when you’re showing enough volume to do so.

I won’t endorse this method for many indicators, but with this one, it’s the most efficient way.

Conclusion

Depending on how you word what you’re talking about here, you will get two very different answers.

A currency strength meter is useless, redundant, and only there to get newbie traders excited so they can go lose their money faster.

A currency strength indicator is probably useless, but worth testing, provided you do it correctly.

As always, we sift through the hype, examine the concepts you (I) want to talk about, to find out what’s useful and what’s not….

…at least from one guy’s opinion. I’m pretty dope though.

— VP

*All search values are taken from the “Keywords Everywhere” plugin for Google Chrome.