You’re winning a trade, and it’s trending beautifully. You want a bigger part of this.

Is there a way to leverage up here?

Episode 25’s question is from Ronny:

“Do you ever add on to a winning trade?”

— Ronny from Santo Domingo, DR

Scaling In

You’ve seen the “Scaling Out” video, right? It’s essential money management. And no money management equals no money. Better watch if you haven’t.

As I type this, the Heiken Ashi video, which came out a week before the Scaling Out video did, has over 3X the views.

Y’all need Jesus.

Anyway, Scaling Out is the art of taking some profit off at a certain point in a trade.

Scaling In on the other hand, is when you add an additional position to an already existing trade.

This can go two ways:

Adding onto a losing trade — the whole “Dollar Cost Averaging” idea, which is so tremendously stupid in Forex trading, this is the last I’ll talk about it (until the video or podcast about it comes out of course).

Adding onto a winning trade — leveraging up by putting an additional position on a trade you’re already in because it’s really starting to trend and you want to max out it’s potential.

There are two ways to do this as well:

- Wait for a retracement first. “Buy the dips” as they say.

- Get on board ASAP before the trend takes off.

And after all that info:

Don’t You Dare Do It

There are no good reasons in my mind to do this.

Let me count the ways…

1 – You’re Being Greedy

Let me guess. You just took a few losses, you got on a trade that gave you a nice amount of pips in a short time, and you think this is the big one, Elizabeth.

You have no idea if this is the “big one”. You have no tools that give you any certainty that it is. Those tools do not exist.

Let’s call it what it really is — greed. Overcompensating. Bad emotional control.

You want to recoup losses, or you’re “on a roll” (not really a thing) and you want to rocket up the account to big levels!!

This could be your golden ticket!!’

But you can’t give me any reason as to why this is the big trend you’ve been waiting for.

It’s greed.

2 – Nothing In Your System Is Telling You To Add On

Did you forget how we do things here?

Step One: Create a system

Step Two: Test the system until it becomes amazing

Step Three: Let the system do the work

Step Four: Stay the fuck out of the way

And now you’re not doing that.

You deserve what comes. And long-term, what comes isn’t pretty because…

3 – The Math Is Very Much Against You Now

If you recall Episode 23, where I talked about the FOMO trade…

FOMO, or Fear Of Missing Out is when you make a rash decision (again, emotions) not based on whether or not you should, but based on the fear of what might be if you don’t.

FOMO can be good every once in awhile.

You’re 45 years old, and have nothing saved for retirement?

FOMO is good here, because it compels you to actually do something about this!

But in the scope of trading, it’s a huge net negative.

In Episode 23, I told you how your system is designed to get you into a particular trade at a perfect time.

Is +20 pips after the fact the perfect time? No way.

That awesome Take Profit level and Stop Loss your system gave you too? Forget about it, it no longer benefits you anymore if you’re doing shit like this.

You no longer in smart trading territory anymore. You’re now taking on unnecessary risk.

It will work a few times, and this will justify your madness.

But overall, it will chip away at your bottom line.

Avoid taking trades that have already gone +20 pips from your original entry.

Now you want to put MORE MONEY on a trade that has gone +100 pips or more???

You’re plummeting into lottery scratch-off ticket-level having-the-math-against-you territory here.

We get the beautiful advantage of having the chance to put the odds in our favor in a market that doesn’t want us to do that.

Don’t do things to purposely screw that up.

“What If My System IS Telling Me To Add On?”

I get this question sometimes too, and I cannot figure out why.

“I’m in a GBP/AUD trade, and my indicator told me to go long again. What should I do here?”

— A staggering number of traders

So my answer would go something like this…

If you have a second long signal for example, after you’ve already gotten a long signal (the one that got you into the trade in the first place)….

….you would have had to have gotten a short signal first.

And if that was the case, WTF are you still doing in that trade??

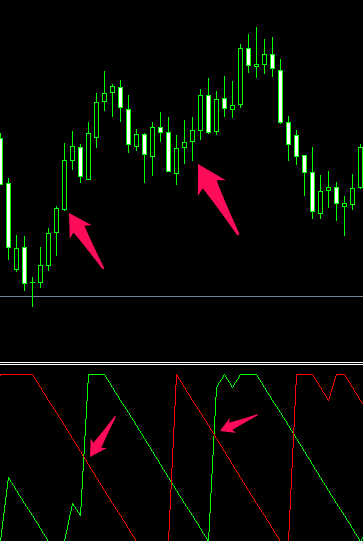

I’ll use the Aroon Up and Down for this example. I showed you how to use this at 17:28 in the Trend Indicators video.

Basically, when the green line crosses the red in an upward fashion, you go long.

When the red line crosses the green in an upward fashion, you go short.

So you’re telling me this is happening:

Here’s my problem though…

Before you had that second long signal, your own confirmation indicator gave you a short signal.

You should have been out of the trade!!

This should not even be a question!!

If your own Confirmation Indicator is giving you a short signal before your Exit Indicator tells you to abort the trade…

- Your Exit Indicator sucks, and you need a new one

- Why are you still in the trade?

So here’s the punchline:

A) You could have scaled in, and made good money here.

B) You could have also exited when the short came, and entered the trade again at the second signal.

The difference is B) is you following a system. B) is you doing things that makes sense, and following a proven system that puts the odds in your favor, and B) protects you from over-leveraging where you shouldn’t.

Conclusion

I hope all of this made sense to you. If you are brand new to the channel, it was probably confusing, but I would implore you to go to the homepage, and start there if you like the way this material teaches you strategy in Spot Forex trading.

It’s worth it in the end.

There’s no substitute for smart money management.

Absolutely none.

— VP