We’ve all thought about it. A robot to do all the work for us? Perfect!

But is it worth it?

Episode 16’s question is from Julio

“Do you use Forex robots or EAs in your trading?”

Julio from Jaen, Spain

Short answer — I don’t, personally. But if you find a good one, it pays for itself over and over again. The chances of finding a great one can be appallingly slim.

It would benefit you to read this.

Define “Robot”

“Robots” in the Forex trading sense, are also known as “Expert Advisers” or “EA’s”

It’s nothing more than a program, that somebody else creates, which you attach to your trading account.

The “Robot”, based on the parameters the programmer sets, will enter and manage trades on your behalf.

That’s it. You have relinquished control of your entire account to a computer program.

Good luck!

I Get It

Look, there are reasons, good reasons why anyone would want to invest in something like this.

Some people don’t want to learn how to trade Forex. They think it’s too hard.

Stock trading is hard. Bond trading is easier, but still hard. And they’re all based on a lot of variables you cannot control.

Forex trading, by comparison, is ridiculously easy. And I’ve put together an entire YouTube channel to make it even easier.

But in the end, what we really want in a constant stream of money flowing our way — regardless of how we get it.

This can come from trading ourselves, or letting something else more effective do the work.

Or do both. This is an even better idea IMO. Learn to fish by becoming a great trader, but have something else there fishing for you all the while in the form of a robot.

If some is good, more is better. Double dip!

I like where your head is at. But we need to look into this more.

Doomed From the Start?

I’ve said this several times before: Most Programmers are not Forex traders.

Conversely, most great Forex traders don’t know programming.

Your best hope is to find somebody who does both, and good luck with that. You can find a great trader who can collaborate with a programmer.

This is better, but with every algorithm out there, the best ones still need to use their brains and their instincts to properly enter and manage a trade.

This is a big problem, because people who program these robots cannot account for this.

At its very core, Forex trading robots are doomed to fail.

Most Robots Do The Things We Know NOT To Do

Just know, and you know by now…

Most robots follow and use some combination of tools found in the Dirty Dozen. Not good.

But what is far WORSE, is that when it comes to money management, the most important concept in Forex trading, robots often violate the main principle of the risk profile I gave you to use.

The ones I have tried in the past all did the same thing.

They asked me how many lots I wanted to trade with.

Not for each currency pair, how many throughout ALL currency pairs!!

Reckless and stupid. I should have known to stop there. But at the time, just like you, I wanted to believe.

Make Sure Your Robot Does This

Now you can still find a good one, I’m sure — law of averages and all.

But there is one crucial factor that it must account for, and this is very difficult to do.

Over the course of a year, and this never fails, you will see the Forex market go through different phases:

- Regular

- Dead

- Wild

- Trending Hard

- Consolidating hard

- Irrationally News-Driven

Can a computer program account for this? Very doubtful. Many are optimized for only one or two of these markets. This benefits the seller of the robot greatly, because if you were to buy one during one of these cycles, you would be very happy with it, and allow many paid months of failure before you dumped it for good.

Then again, if you bought it in a market cycle where it failed, at least the seller would have a month or two’s worth of money, and that’s all they were likely looking for in the first place.

Let’s go deeper into the ways these sellers manipulate the crap out of you.

Ways Robot Sellers Scam You

No thanks Marco, I don’t need one.

But your website doesn’t even prove that. You have no results shown anywhere.

If you have at least two brain cells to run together, you will want to check and see if the robot you are buying actually has a history of winning.

Crazy at it sounds, many people don’t even look for this.

Just because you are checking, doesn’t mean sellers of ineffective and often scammy robots aren’t doing everything they can to mislead you into thinking you’re going to be wildly rich simply by buying their program and plugging into your account.

Let’s look at the many ways unscrupulous sellers manipulate their results. By knowing these methods in advance, you can really protect yourself down the road.

1 – No Results At All

In my findings, this was the #1 way sellers showed their results. I can’t believe it.

They made up for this by having beautiful websites, and flowery language all over the place.

Some of these sites I remember from before, so they’ve been active for years, which means they’re obviously turning a profit somewhere.

People want to live the dream so badly, they’ll do the equivalent of buying sight-unseen land by buying a robot with no results behind it, and allow it to trade on their behalf.

Absolutely bananas.

2 – Typing Their Results into a Table or Spreadsheet

This one made my jaw drop.

Do I even need to explain how crazy this one is?

I want to link to these sites so bad, but I promised I wouldn’t interfere with other people’s business like that.

So these people WILL show their “results”, and they will do this by showing you a table with their monthly results entered in….

Not results taken from their trading accounts? No Ma’am.

Results they entered themselves!

What a concept! Your robot doesn’t get to decide its own fate, YOU do.

You can literally put in any kind of results you want.

500 pips a month? 1000? 2000? There’s no limit!

You must require these people to show results from their ACTUAL ACCOUNT SUMMARIES.

If you don’t, then you are willfully believing the number some goober typed into a spreadsheet. You will officially fall for anything.

A sure sign of this is:

- No account summary shown

- Results that absolutely kill it every month.

Be very aware of these sites. They are everywhere.

3 – Top Loading

This is where the seller has 10-20 accounts running with different robots on each, then elects to only show you the best performers.

“Well that’s fine” you might say, at least it’s working.

It’s working right now. These people clearly don’t know how to make a great robot, but even the worst ones will rattle off a few good months here and there.

This is very hard to catch unfortunately.

The best thing to do here is look for 1 year’s worth of results. It’s the only real way to prevent yourself from buying the one robot in the entire catalog that’s having a record month or two.

4 – Only Showing Wins, Not Showing Losses

Super scumbag move, but it happens a lot.

You can actually set your account summary on a handful of brokers to only show the wins. This can help you, the trader, by seeing what these wins have in common and repeating those habits.

For scummy robot sellers, this is a great way to make you think you are buying a robot with a 100% hit rate.

And watch out for verbiage like:

“+362 pip gain in November”

Because this is not a lie. They just neglected to mention the +508 pip loss in November.

And of course, why on earth would they want to mention that part?

Again, you want to see real results, and know that a 90%+ win rate is fucking impossible, and you should know not to fall for this.

5 – Ridiculous Pip Gains

Would you like a 42000 pip gain in one month?

Shit yeah, I would too.

Do you have any idea how impossible this is?

If you didn’t, you know now.

Maybe if they are trading precious metals, this can be a realistic stat. But in spot Forex, let this be an instant red-flag and vacate their website immediately.

6 – Reckless As Fuck Money Management

You will also see things like a “31% return for the month of June”.

Really?

The only way to ever reach a number like that is by over-leveraging the bajeezus out of your account.

And if they’re over-leveraging it in the good times, they’re doing it in the bad times too.

And if they’re doing it during the bad times, bye-bye trading account.

Shiny-Object Syndrome is one thing. Outright stupidity is another.

Way to prevent this? Don’t be stupid. That’s all I got here.

7 – Doomed To Fail Money Management Systems

Ever heard of Martingale?

This is where you double up every time you lose until you win, then you break even.

Then when you win, you keep the wins.

Fantastic, right?

Let me put it to you this way — in Las Vegas people try this crap out all the time. And it works…

…until it doesn’t. Then you’re completely wiped out.

There’s a reason why nobody who works at the casinos will try and stop you from doing this.

Believe me, they see you doing it. And they’re 100% fine with it.

The same can be applied to Forex trading. And it can produce some really nice results until….you guessed it…

…the one time where it doesn’t work.

Some people will go to a site like MyFXBook to track their results. This can be legit, but over time people have found a way to game this site as well. You can no longer trust it.

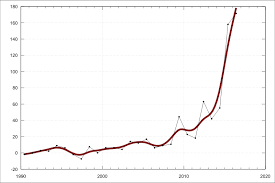

If you ever see a performance chart that has a upward curve with weird little drops in it, you are looking at somebody who is using martingale.

Here is a chart of somebody using the RSI indicator and martingale at the same time. Watch what happened.

These can be VERY easy to fall for if you don’t know what to look for. Now you do. No excuses.

The Most Crucial Step

I don’t disparage you for trying out Forex trading robots. If you do find a good one, use the shit out of it.

But there is one major thing you need to do before committing to one.

Buy one, and plug it into your demo account only for one month, maybe two or more.

Yes, I want you to completely waste your money for at least a month.

You must think long-term here though. If it really is “the one”, you’re going to have it for a very long time.

The LEAST you can do is see if it does what it’s supposed to do.

I mean it, demo it first.

And then the next step is to track its results for a month, and then see if it’s consistent with the result the seller puts up on this website.

Then and only then should you plug it into your account.

And at this point, still be careful. Set it to half of what you would normally put on each trade. These things can go south in a hurry and your precious trading account will be the one who suffers, not them.

Conclusion

Do your freaking homework. Then test it out the right way.

This does not fit with our instant-gratification tendencies, but the risk is great here.

And if everything lines up just right, the reward can be too.

Just know that it probably won’t however.

Learn to be a great Forex trader. Erase all doubt. Leave nothing to chance anymore.

— VP