Market volume and volatility go up, and they go down.

Sometimes they go down and stay down.

We’re trend traders, we need volume. We’re no longer getting what we need.

What changes do we have to make now?

How To Know For Sure

I gave away a tool in the Volume/Volatility video. Here it is, and here is the video telling you how to use it.

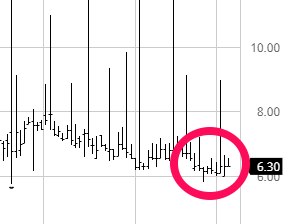

You can set your own baseline on this tool, mine was 8, but regardless, there will be times when volume falls well below it, and stays there.

Just like it is right now.

Not only is it low, it’s staying low, close to the “6” range.

This is not good.

We need volume, and it’s just not there. And we don’t know how long it will remain like this.

Use This To Your Advantage

This is not the market we want, but we can use this time productively.

Many of you are testing your systems for the first time, whether it be backtesting or forward testing.

Would you like to know how well your volume indicators work? Got a few you’d like to test in real time?

Test them now.

They should be telling you not to trade.

If they’re giving you the green light to trade as of right now, March 7th 2019, this is probably not an indicator you want to be relying on.

Volume isn’t there, and surprise surprise, almost no pairs are giving you that nice follow-through we want as trend traders, nor have they for many days now.

If You Are Brand New

And you’re testing your system for the first time, and it’s not yielding a whole lot, or giving you a lot of losing trades, THIS IS NORMAL.

It’s a dead market, or pretty close to one.

These happen, and you just happened to start as one was occurring.

It’s natural chaos theory however — order (what we have), into chaos (what we want), and back again.

Do not be discouraged. Those nice gains you were seeing in the backtesting phase will come back.

But you MUST know what to do in the meantime, or else you’re just going to give all of those wonderful gains right back.

Game Plan

There are a lot of ways to approach dead markets. But there is only one I recommend….

DO NOT TRADE

It sucks, I know. But ya know what sucks worse? Donking away your money for no good reason.

You should NOT be getting many trade signals right now. But if you are getting a few, here are a few things I’d strongly suggest you consider.

Avoid the USD

I say to be skeptical and cautious of the USD in general, and you should (even though it’s okay to trade it under normal circumstances).

But in times like this, the Big Banks are still going to take trader’s money, and this is where it’s going to happen.

Why put yourself at a double disadvantage here?

If you ever see anything move during these times, barring any kind of strange news event, it will almost always be cross pairs.

Take The Entire Trade Off At Your First Take Profit

Whoah! Didn’t see that coming, did you (unless you already saw the video).

Yes, I suggest you go against the hard risk structure I gave you before in the Scaling Out video, and take your entire profit when your trade reaches the ATR.

Why? Because the chances of it going any further are fairly small, and we’ve already seen this.

Take your small wins now. Stack those suckers up. You never know when you’ll need them to cancel out your losses.

If price keeps going, then c’est la vie. Good discipline is good discipline, and this will always win in the end.

Realize You Are Going To Miss The First Big Move

Once volume decides to stop being a dick and come back to us, chances are, your Volume Indicator won’t be quick enough to catch this move.

Again, it’s the price we pay for good discipline and smart trading.

Learn to accept this probable reality.

If anything be happy! This just might our volume coming back for good!

Don’t Make Me Say It

And the final thing, and I can’t believe I’m saying this, but….

This is the ONLY time I will give the okay to do this one thing.

And ONLY do it if your success is on the line somehow (and smack yourself first for allowing it to get there).

But if you absolutely must, you can go ahead and………….

Trade Smaller Time Frames

Barf, I said it.

Is there no follow through on the daily time frame?

There probably is movement and follow through on the smaller time frames however.

And I’ve said it before too, this system will work on just about any time frame, just not as well as it does on the Daily.

So let that instant gratification monkey out for a bit, and trade those lower time frames you’ve always wanted to trade.

Just don’t be shocked if the results fall below your expectations.

You’re now dealing a lot of crap (more news, sessions, the way the Big Banks handle intraday moves, etc) that you weren’t before.

And come back home when it’s time.

Conclusion

There’s nothing worse than getting big gains, only to give them back because you were foolish and unprepared.

Now you’re prepared.

So if you give away your money now, you’re just foolish.

And a fool and their money are soon parted.

I can’t help you there.

— VP