If Tether goes, we all go.

But does it deserve to go? Will it remain regardless?

Before We Start

I had an interesting YouTube comment on one of my podcasts saying how a USDT collapse would kill crypto altogether.

I don’t believe this one bit.

Saying this would assume that Bitcoin has no more use case.

It would also assume blockchain technology, the technology that is going to send us into the future, is all of a sudden dead too.

No more NFTs, no more DeFi, no more metaverse, no more tokenized finance, no more BTC, etc. All because Tether goes down??

Yeah, no.

The market will take a massive shit (That’s what I mean by “If USDT goes, we all go) — but it won’t die.

So don’t become THAT kind of doomsdayer. It just doesn’t make sense.

An Indestructible Force

People have been firing shots at Tether for half a decade now.

Hit pieces, scathing breakdowns, requests to see funds, etc.

Yet it just keeps right on surging.

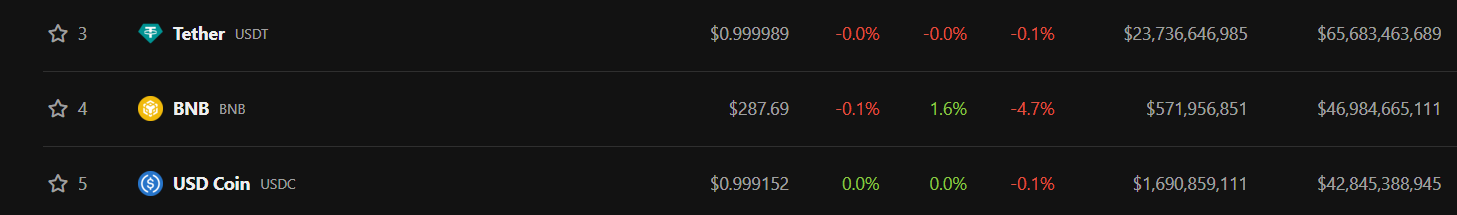

USDT still remains at number 3 on CoinGecko, and remains the top stablecoin in existence.

Their market cap is more than 50% higher than their main competition USDC.

It makes you wonder, as damning as some of the evidence has been against Tether, why does it keep marching forward regardless, barely even taking time to pause?

Let’s take a look at some reasons why…

1 – It’s The International Stablecoin

Tether is the only stablecoin with nothing holding it back.

USDC still cannot be used in a lot of countries.

You can’t use BUSD unless you’re a Binance customer.

DAI should probably be more used because of it’s decentralized nature, but it is used in far less places than USDC.

USDP is not easy to swap for, for some reason.

TUSD has KYC. Too much to ask for a simple stablecoin.

Tether is top here by a mile, even if it’s only be default.

2 – They Probably Have the Funds Now

We can debate all day whether USDT had the funds they claimed to have back in 2017-2018.

Honestly, they probably didn’t.

But I think they realized “Hey, we don’t have to be shady. We can simply do things by the book, dominate the market, and not go to jail. Let’s do that instead.”

And I think they’re finally there now.

Tether CEO Paolo Ardoini laid it out, in the interview below. He’s a bit jittery, but I still thought it was a good interview for the pro-USDT cause.

This is a good thing, because due to the FTX fallout, governments are looking to deal as many regulatory death blows to the entire industry as they can.

And what better target than the #1 stablecoin, which has been in high suspicion for years now?

They’re making moves as we speak.

But at the end of the day, I think it’s no more than window-dressing.

Why do I say this?

3 – Tether is the Illumin*ti Coin

The secret has been seeping out into social media for the last few months now, and has been increasing since the FTX debacle.

I really wish I would have hearted some of these threads on Twitter so I could have dug them up and put them here, you may have come across a few of them yourself, especially in the past month or so, but even I don’t like to have record of those things on my timeline.

Call me paranoid, it’s just not worth it.

The Twitter threads in question did a full breakdown of how USDT is being used nowadays instead of cash as the payment method for extortion, bribery, and pay for those type of military missions you read about in Tom Clancy novels.

And before you jump in, I don’t think they’re using something completely transparent like the Ethereum blockchain to do it, nor are they paying all at once to have these transactions stand out.

“But that seems so clumsy to have it all out there like that!”

Who is going to investigate them? Themselves? And unless you know the originators’ addresses (plural), locating this stuff is going to be almost impossible.

It does make some sense too, as the world is moving further away from cash, may as well get this ball rolling now.

And with all of the questions being raised from SBF and his family’s ties to the current government, it makes even more sense.

Governments know blockchain is inevitable. So they can either try and shut it all down, control all of the US portions of it (which the SBF family/government cabal attempted to do), or simply turn it into their own financial playground when it’s all said and done, which is what I personally believe they have moved on to today.

And Tether will play a major role here IMO. Because it already is.

What else are they going to use? After USDC, the other coins don’t have enough liquidity. Too easy to end up on the radar. Not with Tether though.

USDC will be used to control the people via FedCoin, while the elites and the people they favor will use Tether for all the things they want to do.

Sad, but on the plus side this means USDT probably is in fact “Too Big To Fail”, and will be around for traders and the majority of countries to use for years to come.

Conclusion

If you are invested or merely interested in the crypto industry at all, you absolutely MUST pay attention to Tether and what’s going on behind the scenes.

It’s that important.

But for the reasons stated, especially the last one, I think we’re going to be fine.

NFA

— VP