It’s the event which caught absolutely nobody by surprise.

But we still need to talk about it.

Basics

If you didn’t already know, the “Halving” refers to an event every 4 years where Bitcoin miners can only mine half of what they used to before.

In other words, supply cuts in half every 4 years.

There are some concerns this will centralize miners far too much over time, and the larger companies who have their costs in order will get larger and larger.

We’ll see. This isn’t important right now, nor will it be for awhile.

The other talking point is more of a negative one, where people are saying, “It doesn’t really matter because most of the BTC is already out in circulation”.

Uhhhhh, so is most of the world’s iron ore, but if its supply were to get cut in half tomorrow, the ripple effects would be extraordinary.

Truth is, this is quite significant, even though it’s never going to catch anyone off guard.

A lot of podcasters and YouTubers want to talk about it because they put out too much material and always need something to talk about no matter how watered-down it may be (as I sit here blogging about it, because yes, on the blog I reeeeaaaalllllly need shit to talk about so thank you Bitcoin Halving!!).

But the main reason this is so significant is because as we have mentioned in the past, supply is getting cut in half while demand is skyrocketing.

So much to the point, where I predicted we will start having real situations where people want to buy Bitcoin from these custodied providers such as PayPal, CashApp, Wells Fargo, and some of the smaller ETFs for example, but these providers may not have enough to give if they didn’t play their cards right.

Don’t say I didn’t warn you.

It’s simple math. There are only 21 million BTC out there, minus the ones that were lost forever or went with people to the grave, minus the ones which haven’t been mined yet.

These are 100% finite resources, and yes pizza lady, you can divide them down to one Satoshi, but that doesn’t change how many are out there.

And if there is a supply squeeze, there is literally no way out of it.

I want to emphasize this, because very few people are.

And the reason why they don’t is because their audience is less likely to be long term buy-and-holders, so their main focus is on short-term price movements.

But for us? Very significant.

While we’re here, what is far far less significant is the news of the Strike App becoming available in Europe.

Long story short, very few people want to transact in an asset that goes up this much. Big on dreams, small on thinking in realistic terms.

Bitcoin To A Bazillion!!

Price predictions with these things are useless.

You can do what I always do and bet on the UNDER, and you will probably win every time.

But that’s okay, because as soon as my UNDER bet fails, I’m not going to give much of a shit about being wrong, I’ll tell ya that.

Because once we’re off to the moon, we’re really going to be off to the fricking moon.

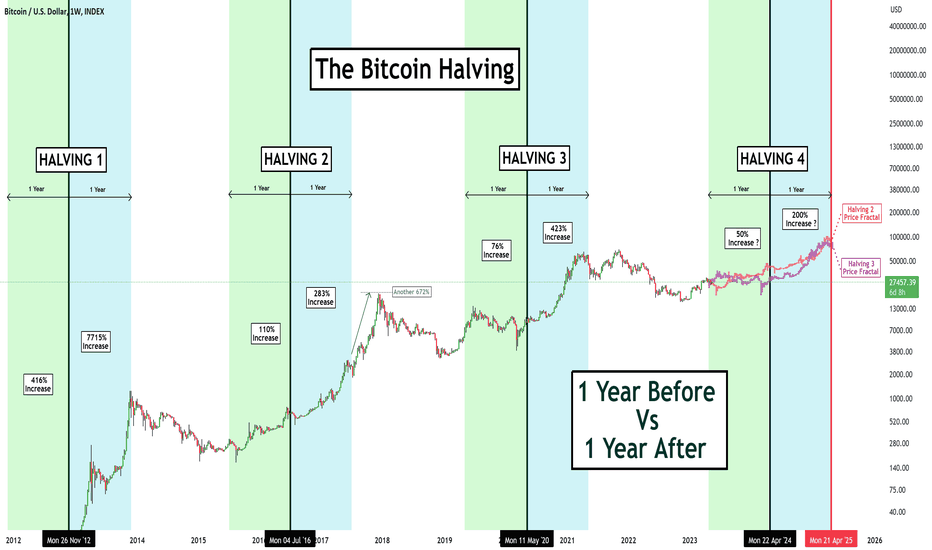

Here is one of the better charts I’ve found showing the year before and the year after previous Halvings.

There’s always a move up in that first year.

But this time it really is different.

No more big dreams and “what if” scenarios like before.

The one thing I was waiting for this entire time has happened.

Institutions have a real way in via the ETFs.

This is Game Over for me.

This is why I tweeted on October 11th 2023 that I bought more BTC at $28k after initially buying near $8600 (documented on the blog), because I was finally sure it was happening.

All the talk about financial collapse, money printing, Moore’s Law, blah blah blah, sure, great.

Allowing the real money to enter was the floodgate I wanted this whole time, and we got it.

We may have to eat a bit of shit along the way if the recession hits during this time, that’s fine, I mean who is only in it for a year or two at this point?

All of the arrows long term point up.

HODL/DCA. And never think it’s too late.

Cuz it aint. Not by a long shot.

NFA

— VP